We understand that saving for retirement can be a challenge. Not only do you need the day-to-day discipline to stick with your savings strategy, but you have to keep up with IRA rules and regulations. We can help. One common retirement savings tool is a traditional IRA.

Traditional IRAs are tax-deferred, which simply means you generally won't pay taxes on the money in your IRA until you start withdrawing it. At that time, the money you take out of your IRA will be taxed just like regular income. On the front end, the money you deposit today into your traditional IRA may be deductible from your taxable income.

Many people find themselves in a lower tax bracket when they retire. This means that while you're working, you may get a bigger tax break on IRA contributions. Then, when you withdraw the money later in life, it's potentially taxed at a lower rate.

How much you can contribute

Beginning with tax year 2020, an individual is eligible to contribute to a traditional IRA, regardless of age, as long as they have taxable compensation. 2019 and prior years, contributions could not be made for the year an individual turned 70½ and older. For 2020 and 2021, you can generally contribute up to $6,000. If you're 50 or older, you can make a $1,000 "catch-up" contribution.

Do you qualify for a deduction?

Your ability to deduct contributions today generally depends on your participation in your employer's retirement plan and your income. If you are:

- Single and don't have a 401(k) or other retirement account through your employer, you can deduct your full contribution.

- Married and neither you nor your spouse has an employer retirement plan, you can deduct your full contribution.

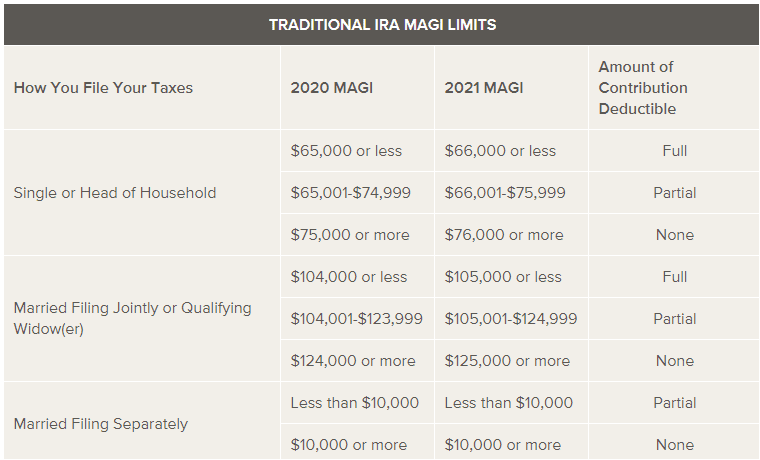

- Covered by a plan, or your spouse has one through work, the amount of the contribution that can be deducted will depend on your modified adjusted gross income (MAGI).

Can you deduct your contributions?

What else you should consider

Rolling your 401(k) into an IRA is another option. With an IRA:

- Penalties – If you withdraw money from your IRA before age 59½, you may be required to pay a 10% IRS penalty in addition to income taxes – but there are exceptions. If you need the money for college, a first-time home purchase, or expenses for medical purposes, death, disability and health insurance due to a period of unemployment, you may not have to pay the early withdrawal penalty.*

- Required Withdrawals – When you reach age 72, the IRS generally requires you to withdraw a minimum amount each year. These are called "required minimum distributions," or RMDs. At Edward Jones, we calculate this amount for you automatically. So if you have IRAs outside Edward Jones, consider consolidating them so we can help make the RMD process easier for you.

- Contribute All Year – You can contribute to a Traditional IRA throughout the year and up until your tax-filing deadline – usually around April 15.

- Roth IRA Conversions – If you have a Traditional IRA, it might make sense to convert some or all of it to a Roth IRA.

Important Information:

*Withdrawals are subject to IRS rules and regulations. Please see your qualified tax professional for all the relevant information before making a decision.